If you have 15 000 to invest you could invest 5 000 in each rung.

Current cd ladder rates.

The initial rate on a step rate cd is not the yield to maturity.

Navy federal credit union apy.

Typically the longer dated cd ladders pay higher yields than the shorter dated ladders because cd rates generally follow the upward sloping rate structure of the yield curve.

Open an online capital one 360 cd to earn an interest rate with guaranteed yield.

In fact it s a good idea to shop around for the best rates on each cd term.

Enjoy the protection of fdic insurance and zero market risk with an online cd account.

If your cd has a call provision which many step rate cds do please be aware the decision to call the cd is at the issuer s sole discretion.

How we make money.

On the other hand the 1 year cd ladder has maturities every 3 months.

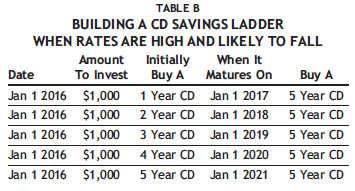

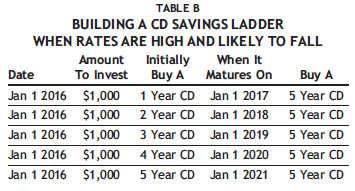

It s called a cd ladder and it enables you to access the higher rates offered by 5 year cd terms but with the twist that a portion of your money becomes available every year rather than every 5.

Synchrony cd rates have a minimum of 2 000.

Compare our cd terms and annual yield rates.

Step rate cd rates 2 500 minimum opening deposit a step rate cd time account is a 24 month cd featuring guaranteed interest rate increases and one penalty free withdrawal every six months provided the minimum opening balance is maintained.

This can be helpful for creating a short term cd ladder which is a more flexible approach to saving in cds than holding funds only in long term cds.

For instance a cd laddering plan of three cds might have a one year cd a two year cd and a three year cd.

As you build your cd ladder you re not under any obligation to open all of your cds at the same institution.

If your cd has a step rate the interest rate of your cd may be higher or lower than prevailing market rates.